Skip to content

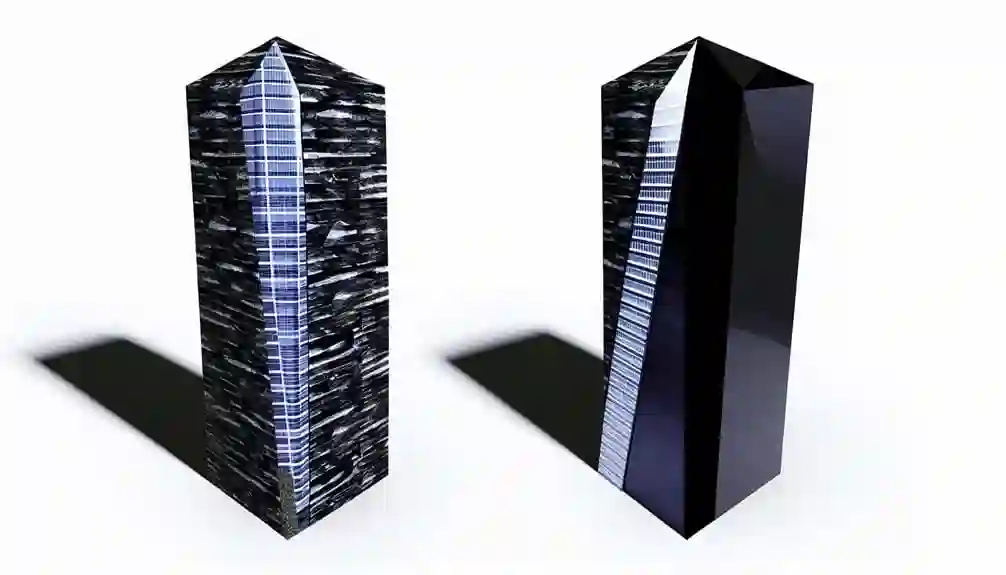

Blackstone Vs Blackrock: Battle Of The Giants

Blackstone vs blackrock The world of budgeting has long been fascinated by the fierce competition between two of the most powerful companies in the entrepreneurial category: blackstone vs blackrock Although their names sound relatively similar, the companies operate in specialized fields and pursue different venture strategies. Despite their contrasts, both are budget powerhouses that have played fundamental roles in shaping global markets and amassing billions in assets under administration (AUM). Understanding the nuances of Blackstone and BlackRock gives financial experts and advertising observers a handle on the flows that drive their influence and dominance.

Understanding Contrast: Blackstone Vs Blackrock

Blackstone: A Private Equity Behemoth

Blackstone is a driving global valuation firm known primarily for its private valuation expertise. Founded in 1985 by Stephen Schwarzman and Diminish Peterson, the firm initially operated as an advisory firm that recently expanded into venture administration. Blackstone’s trade shows often buy, restructure and offer companies or assets with the goal of generating long-term returns for its investors.

At the core of Blackstone’s operations is its private value business, where it ensures controlling stakes in companies on various segments, calculating actual domains, vitality and financial administrations. The firm operates in credit, support reserve and genuine domains, advertising different venture items. Its ability to raise significant capital from regulated financial specialists such as benefit reserves, peak asset reserves and gifts has empowered it to amass an astonishing portfolio of assets valued at trillions of dollars.

A key thing that sets Blackstone apart from its competitors is its overwhelming reliance on private equity, which includes long-term projections of companies. Unlike traditional open value speculation, which involves offers to buy companies that are freely exchanged, private value speculations regularly have long time horizons, often extending from 5 to 10 long periods or more. Blackstone has outperformed expectations to secure and transform companies offering them substantial gains over the long term for some time recently.

BlackRock: Lord Of Wealth Management

BlackRock, in 1988 Larry Fink, Robert S. Founded by Capito and Susan Wagner, the world’s largest resource management company. Unlike Blackstone at all, BlackRock is not focused on private value or control businesses; Instep, it works fundamentally as a resource chief that advertises a wide range of speculative items. BlackRock oversees everything from stocks and bonds to genuine domains and private value stores for a global client base that includes academic, government and individual investors.

One of BlackRock’s most important achievements is its advancement and dominance in the field of exchange-traded stores (ETFs). BlackRock’s iShares division is the largest provider of ETFs, and the firm has revolutionized how financial professionals approach portfolio development and resource assignment. ETFs have made it less demanding for people and corporate speculators to spread their holdings at lower incomes. BlackRock’s ETF triumph is one reason it’s often viewed as a titan of passive speculative management.

While Blackstone’s estimates are more dynamic and focused on long returns, BlackRock’s approach is broader, integrating both dynamic and passive estimation strategies. Passive investing—wherein a financial expert dictates a copy of the ad record or perhaps doesn’t try to beat it—has gradually become well-known, especially with BlackRock’s wide range of ETF offerings. By managing low-cost, highly diversified ventures, BlackRock has attracted huge amounts of capital, allowing it to develop its resources under management to staggering levels.

A Look At Finances: Blackstone Vs Blackrock

Blackstone’s Energy Related To Money

Blackstone has proven itself to be one of the most successful private equity firms in history. Its portfolio of assets includes high-profile companies in segments such as real domains, vitality and innovation. The firm has reliably delivered solid returns to its speculators, and its ability to pull in regulatory capital is a testament to its success in overseeing complex, high-risk speculation. With over $1 trillion in assets under administration (AUM) across its various practices, Blackstone is a key player in private equity and alternative investments.

However, Blackstone’s trade show differs from BlackRock in that it primarily generates income through private value administration and real estate speculation. The firm charges administrative expenses, which are regularly the rate of capital it oversees, and also earns executive expenses when its ventures exceed certain return thresholds. This performance-based display encourages Blackstone to deliver above-market returns for its financial experts, often at the toll of taking on more risk.

BlackRock’s Budget Dominance

In contrast, BlackRock is a dominant force in the resource administration world, where resources under administration exceed $9 trillion—far more than Blackstone estimates. BlackRock’s trading exposure is based on various enterprise items, shared reserve calculations, ETFs and fixed-income securities. The firm’s broad reach in both dynamic and discrete contributions has allowed it to capitalize on the developing trend toward low-cost, comprehensive enterprise solutions.

BlackRock has a deeply effective trade show, generating substantial income from administrative costs, which are typically a small percentage of assets under administration. Despite its low-cost structure, BlackRock’s sheer scale and the sheer volume of assets it oversees allow the firm to build significant leverage. BlackRock’s revenue also benefits from global demand for ETFs, as its iShares division is a pioneer in this space. Not at all like Blackstone, which is more focused on private value and alternative ventures, BlackRock offers a wider spread of wealth management items for different clients.

Investment strategy: blackstone vs blackrock

Blackstone’s dynamic administration and private value focus

Blackstone built its reputation on dynamic administration, particularly in the private equity space. The firm is known for its hands-on approach to business transformation. Whether through restructuring, operational enhancements, or cost reduction measures, Blackstone’s expertise lies in turning around under-performing resources to create value.

The firm’s private value propositions routinely include taking broad ownership in companies and using its financial power to advance their operations. In some cases, Blackstone took or sold companies to other speculators, creating significant benefits for its speculators in the process.

In expanding private value, Blackstone has expanded into other elective resource classes, calculating actual wills and credits, using its expertise in overseeing liquid assets to achieve solid returns. Blackstone’s real estate division, for instance, has become an unstoppable drive to own and oversee billions of dollars in commercial real estate, office buildings, shopping centers and private properties.

BlackRock’s idle speculation and global reach

BlackRock’s venture approach is based on providing speculators with access to various resources through both dynamic and discrete administration. The firm’s passive approach, mainly through its iShares ETFs, has paid off handsomely in capturing a significant portion of the global ETF market.

The key advantage of passive contributions is its cost-effectiveness, as BlackRock’s ETFs cost less than actively managed reserves. Speculators benefit from exposure to a broad cluster of resource classes, calculation stocks, bonds, commodities and genuine domains through a single ETF. This broad approach allows financial specialists to spread their opportunities and maintain a strategic distance from the volatility that can come with more concentrated investments.

Over time, BlackRock has expanded its estimation offerings to include elective resources such as personal values, structures and real wills. These items reflect some of Blackstone’s methods but are planned to cater to regulatory financial specialists seeking higher returns from unconventional resource classes with a broader market focus.

Market Effect: blackstone vs blackrock

Blackstone’s impact on global markets

Blackstone’s influence is most noticeably felt in the private equity and real estate markets. The firm has played an urgent role in integrating and transforming the entire business. Through its acquisitions, Blackstone has reshaped segments such as vitality, healthcare and back, often bringing a level of operational efficiency that essentially upgrades the reputation of its portfolio companies.

As one of the largest private equity firms publicly, Blackstone’s influence extends past the ventures it owns. The firm’s ability to raise capital made a difference in the showcase pattern, particularly the real domain and the elective venture. Blackstone’s key acquisitions often lead to sweeping advertising changes, affecting everything from administrative systems to the business models to which it contributes.

BlackRock’s influence on speculative strategy

BlackRock’s dominance in the resource administration world has reshaped the way both individuals and corporate speculators approach portfolio development. Through its administration of the ETF Showcase, BlackRock has revolutionized how individuals contribute, providing a low-cost, productive way to access global markets. The firm’s emphasis on discrete contributions has significantly shifted the speculation landscape, driving toward a broader selection of index-based strategies.

BlackRock’s influence can also be seen in its promotion of economic contributions. The firm has made a critical commitment to natural, social, and governance (ESG) variables in its estimation form. As a major player in global markets, BlackRock’s move toward ESG-focused initiatives has made a difference emphasizing supportability at the bleeding edge of corporate decision-making.

Conclusion: Clash of the Titans

In a constant blackstone vs blackrock battle, each firm has built an unassailable position in distinct segments of the entrepreneurial world. Blackstone thrives in the high-risk, high-reward world of private equity, using its expertise to secure, restructure and offer assets for significant benefit. BlackRock, on the other hand, is the undisputed pioneer in resource administration, particularly in the ETF space, advertising cost-effective venture arrangements to a global audience.

While Blackstone’s center is on dynamic governance and private value, BlackRock’s approach combines both dynamic and discrete approaches, involving a wide range of speculators. Both firms reshaped the global finance landscape in general terms, with their influence extending past their portfolios. The competition between Blackstone and BlackRock is a confirmation of the mammoth’s control of the initiative in shaping the advanced financial ecosystem.

As both organizations move to evolve and adjust to the ever-changing landscape of global funding, the dispute between blackstone vs blackrock will remain in the realm of speculation. Whether through Blackstone’s transformative private value proposition or BlackRock’s pioneering approach to discrete contributions, these companies are poised to play an essential role in the future of global markets.

Read More latest Posts